Make an

impact today!

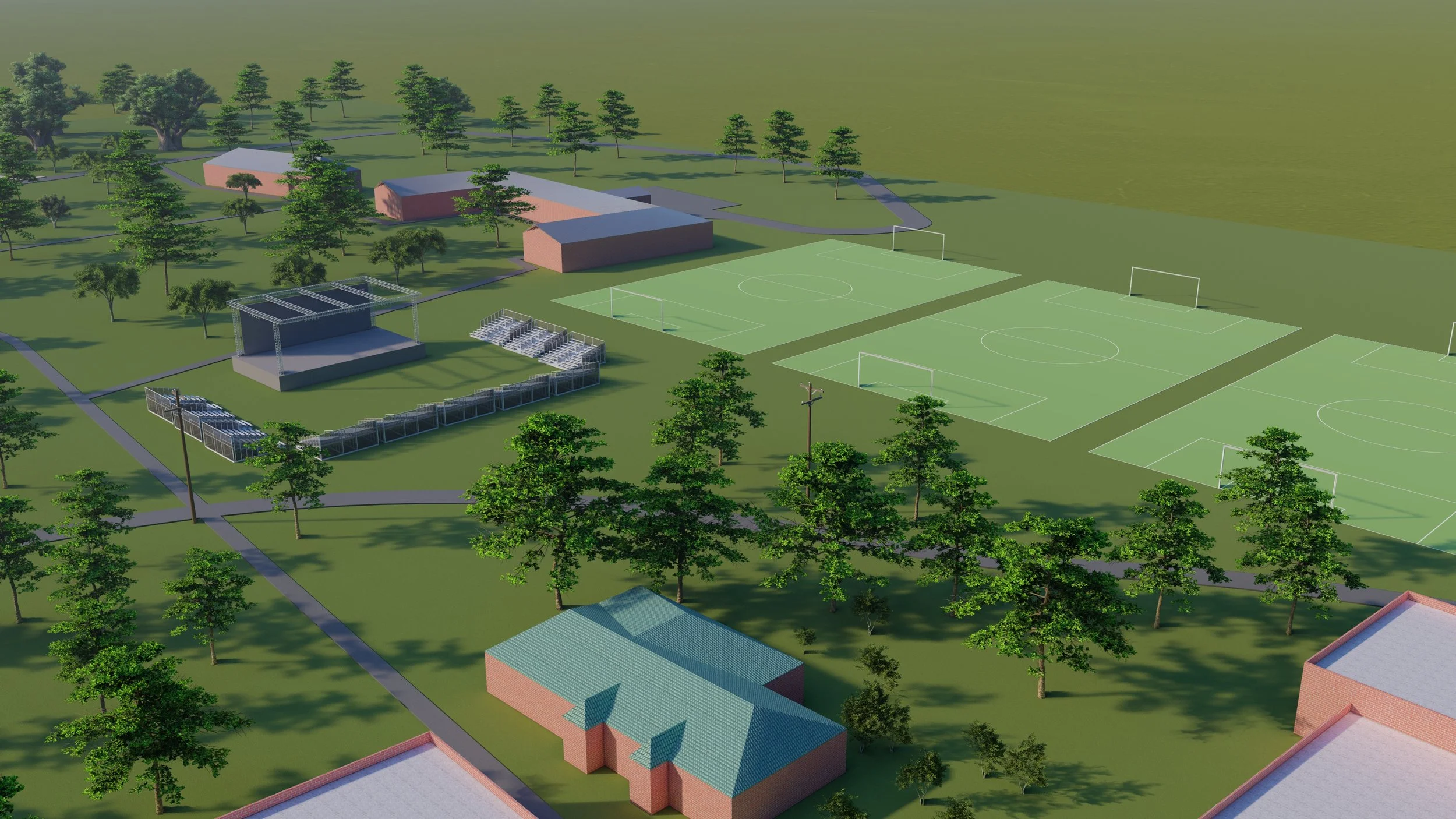

Partner with us to reimagine the future.

There are many ways to financially support Boggs Rural Life Center, Inc.

Ways to Give

-

Please make your check payable to Boggs Rural Life Center, Inc. and mail to:

Boggs Rural Life Center, Inc

P.O. Box 178

Keysville, Georgia 30816 -

There are many ways to support Boggs Rural Life Center, Inc with your assets: making a qualified charitable distribution from your IRA, recommending a grant through your donor advised fund, or making a stock donation. Please contact our executive director at gricks@boggrlcinc.org.

*Please discuss these options with your financial professionals.

-

Many companies offer matching gifts or payroll deductions to nonprofit organizations. Please check with your HR or community engagement team for more details.

-

It’s fast, safe and free to donate stock through the most trusted name in stock gifting. Please click here for more information.

-

A grant from your donor-advised fund (DAF) to the Boggs Rural Life Center, Inc. can support everything from affordable housing to farm opportunities for entrepreneurs to programming for our youth.

1. Give online.

Click Here to immediately connect with your DAF provider and make a donation.2. Contact your financial institution or DAF provider directly.

The grant may arrive at the Boggs Rural Life Center with only the institution's name and address on it. Please request that your name and address be included so we may thank you for your generosity.3. Call your philanthropic advisor or fund manager.

A check from your fund will be sent directly to Boggs Rural Life Center, Inc.

When granting through your donor-advised fund, please include the following information:

Tax ID

58-1889136

Mailing Address

Boggs Rural Life Center, Inc., P.O. Box 178, Keysville, Georgia 30816

________________________________________________________________

Benefits of establishing a donor-advised fund

When you establish a DAF with your financial institution or community foundation:

You receive a tax deduction for the year in which you contribute to your DAF.

You have the flexibility to grant specific amounts to the charities of your choice at a later date.

If you have any questions, please email gricks@boggrlcinc.org.

Why give?

-

Your Gift Is Tax-Deductible

As a registered 501(c)(3) nonprofit, every donation you make can be deducted on your taxes—helping you give back while keeping more in your pocket.

-

You’re Investing in Rural Communities

We believe strong communities are the backbone of a strong nation. Your support helps revitalize rural areas with education, job skills, and economic opportunities.

-

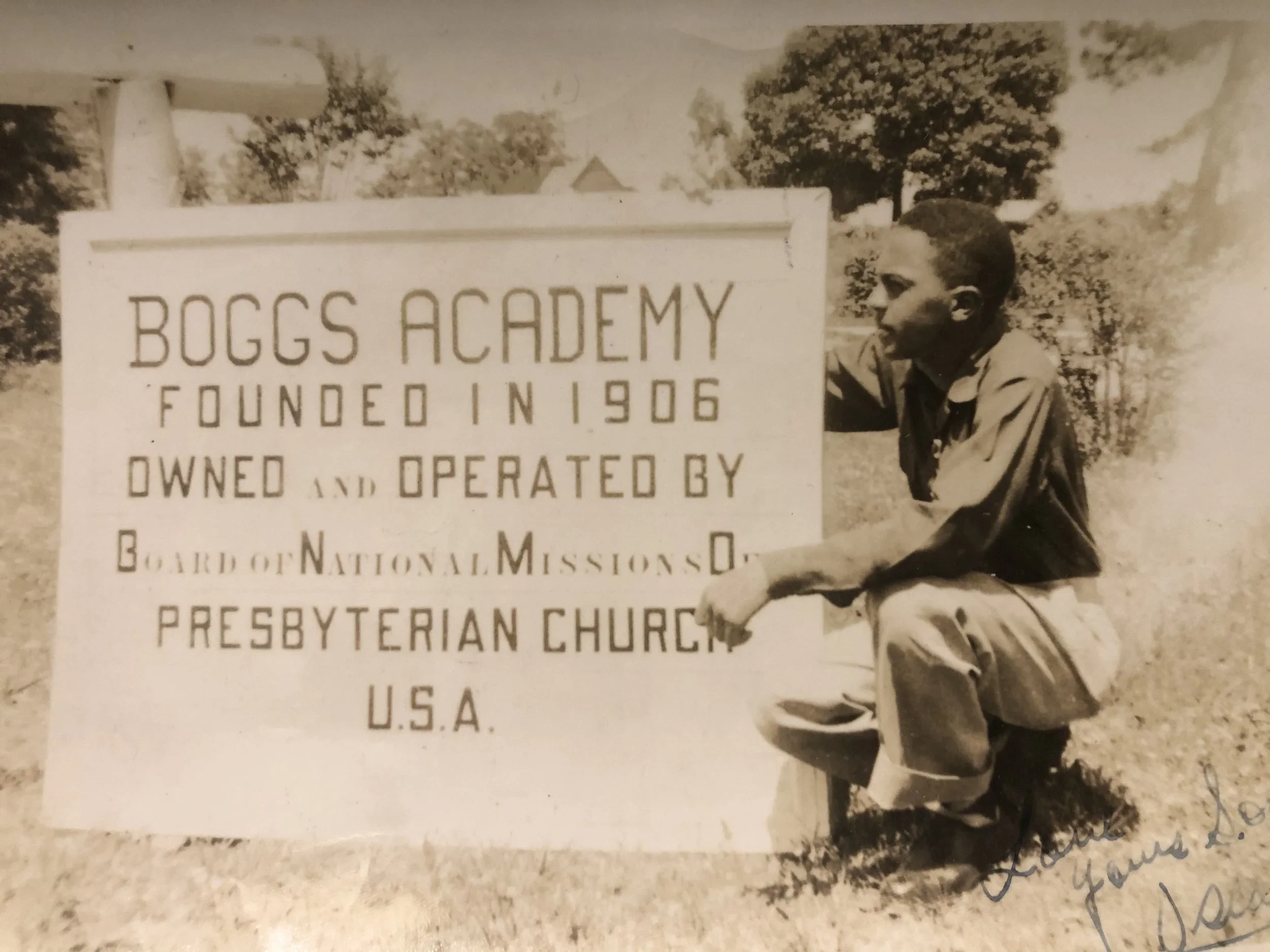

You’re Preserving History and Legacy

Boggs Rural Life Center is a living part of our nation’s story. Your gift protects this historic landmark so future generations can learn, work, and grow at Boggs.

our supporters

“I had the profound pleasure of WITNESSING a new beginning at the Historic Boggs Academy. I am greatly impressed and have a goal of giving $5,000 yearly.”

Tommy Ingram

President of Student Veterans of America “SVA” at Augusta Technical College

“we CULTIVATED a story of Boggs that weaves together the history of the school, the lives of the alumni, and the profound meaning of family.”

Caroline Whitcomb

“I give because Boggs gave to me.”

Joseph Barnes

Class of 68